· Best in class physical retail passes Covid-19 ‘stress test’ with global rebound in rents

· Luxury brands showing resilience and cities experience increase in leasing activity

· Cushman & Wakefield’s global report tracks 92 cities

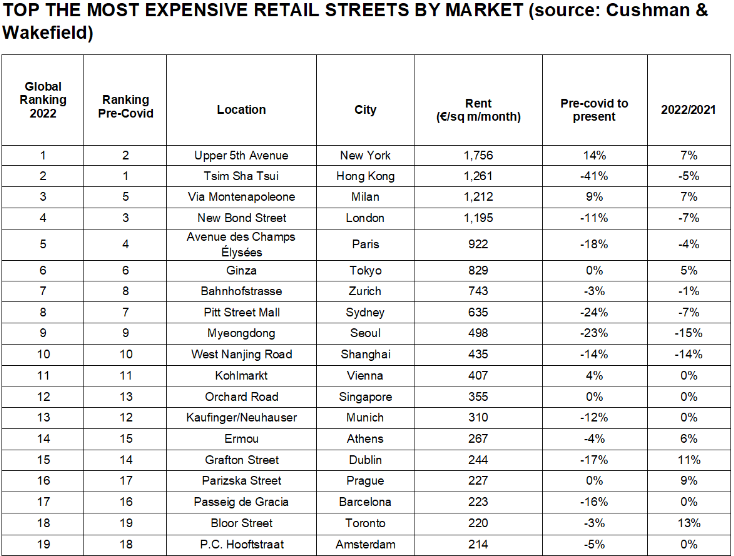

November 2022 – New York’s Fifth Avenue has reclaimed its position as the world’s most expensive retail street, with average rents of 1.756 euro/sq. m/lmonth according to a new global ranking from real estate services firm Cushman & Wakefield.

Pegging the Hong Kong dollar to the U.S. dollar has helped Hong Kong maintain a high-ranking position in 2022 in second, with Tsim Sha Tsui at €1,261/sq. m/month displacing Causeway Bay as the territory’s representative in the rankings.

In third, Milan’s Via Montenapoleone at €1,212 sq. m/month is Europe’s most expensive shopping street for the first time, climbing above New Bond Street in London and Avenue des Champs Élysées in Paris.

Cushman & Wakefield’s flagship ‘Main Streets Across the World’ report, first launched in 1988, tracks the top retail streets across 92 cities and ranks the most expensive by prime rental value utilising Cushman & Wakefield’s proprietary data. An annual report until 2019, this is the first since then – allowing insight into comparative performance pre- and post-pandemic.

Robert Travers, Head of EMEA Retail at Cushman & Wakefield, said: “The industry has been through one of the biggest stress tests imaginable over the past few years, but best in class retail real estate has remained robust. While we now face new economic challenges, the conversation has shifted from pessimism to retail´s omnichannel evolution”.

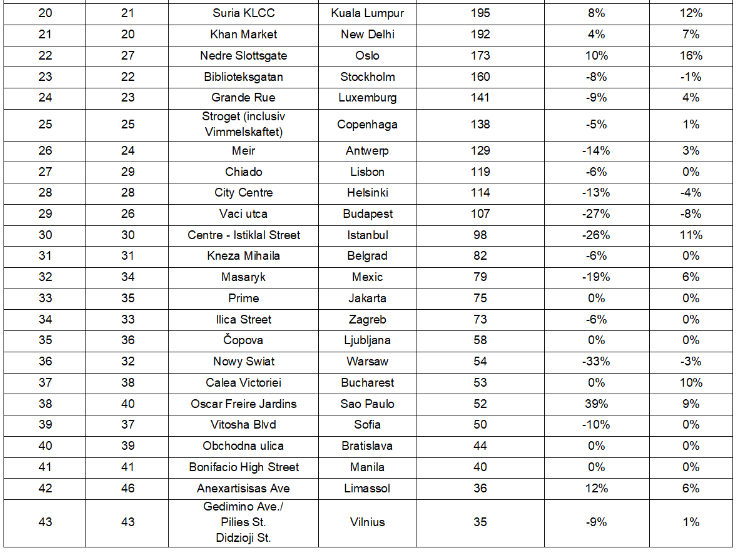

With a rent level on Calea Victoriei, the main retail street of the city, of €53/sq. m/month, Bucharest remains in the top 50 cities analyzed worldwide and in position 46 out of 53 in the EMEA ranking, just behind Warsaw. In Prague, Budapest, Zagreb and Belgrade the rents are above the level in Bucharest, a lower value being recorded in Sofia, Bratislava, Vilnius, Riga or Skopje.

Dana Radoveneanu, Head of Retail Agency Cushman & Wakefield Echinox: ”The Cushman & Wakefield global report analyses the high street retail occupied predominantly by luxury brands, a retail segment which managed to quickly recover after the complicated initial stages of the Covid-19 pandemic and the subsequent restrictions. This positive trend can also be observed in the results reported by the luxury retailers present in Romania, such as Louis Vuitton or Rolex. Unfortunately, Calea Victoriei, the only Romanian commercial street included in the report, probably has the smallest fashion component in its tenant mix compared with the other analyzed European locations. However, considering that Calea Victoriei has become an increasingly popular destination, especially for its high variety of restaurants, cafes or bars, we believe that we will also a development of the fashion segment in the coming period.”

Dana Radoveneanu, Head of Retail Agency Cushman & Wakefield Echinox: ”The Cushman & Wakefield global report analyses the high street retail occupied predominantly by luxury brands, a retail segment which managed to quickly recover after the complicated initial stages of the Covid-19 pandemic and the subsequent restrictions. This positive trend can also be observed in the results reported by the luxury retailers present in Romania, such as Louis Vuitton or Rolex. Unfortunately, Calea Victoriei, the only Romanian commercial street included in the report, probably has the smallest fashion component in its tenant mix compared with the other analyzed European locations. However, considering that Calea Victoriei has become an increasingly popular destination, especially for its high variety of restaurants, cafes or bars, we believe that we will also a development of the fashion segment in the coming period.”

Rents across global prime retail destinations declined by 13% on average at the peak of the Covid-19 pandemic but have subsequently rebounded to just 6% below pre-pandemic levels. Global rental growth over the past year averaged 2% but has varied tremendously.

APAC was the most impacted region during the pandemic period with rents falling 17% on average, mainly due to border closures affecting prime international tourist destinations. In EMEA, rental declines averaged 11%, while the decline in the Americas was just 7%, thanks in part to supportive fiscal policies and domestic migration patterns boosting buying power.

Since the pandemic nadir, global retail market rents have recouped approximately 50% of their losses. Much of that improvement has occurred through 2021 and into early 2022 before global economic headwinds started to negatively impact markets over the past six months.

At the peak of Covid-19, rents in EMEA fell by an average 11% although varied considerably according to the severity of rolling lockdowns. Ireland, the UK, Spain and France experienced significant impacts as rents fell by up to 28% on average. Meanwhile, changes were minimal in parts of Eastern Europe such as Slovakia and Slovenia.

Prime rents have rebounded in the region to just 8% below pre-pandemic levels and at the beginning of 2022 the EU region recorded retail sales volumes 4.1% higher relative to levels when Covid-19 first emerged. However, recovery has and will continue to be challenged by inflation, impacting consumer demand and retailers alike.

Despite the challenging near-term economic outlook, Cushman & Wakefield has witnessed a wave of newcomers entering the market, exploring physical retail. Over the last 18 months, 75% of the retail transactions Cushman & Wakefield represented in EMEA were new leases, highlighting the value retailers place on a physical presence.

Notes to Editors:

Methodology: This report focuses on headline rents in best-in-class urban locations across the world which, in many cases, are linked to the luxury sector. The rental values in this specific segment have been relatively immune to additional discounts, incentive packages or shared risk rental models that have become more prominent in the wider retail markets globally.

Cushman & Wakefield Echinox is a leading real estate company on the local market and the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, with a team of over 80 professionals and collaborators offering a full range of services to investors, developers, owners and tenants. For more information, visit www.cwechinox.com

Cushman & Wakefield, one of the global leaders in commercial real estate services, with 50,000 employees in over 60 countries and $ 9.4 billion in revenue, provides asset and investment management consulting services, capital markets, leasing, properties administration, tenant representation. For more information, visit www.cushmanwakefield.com